[ad_1]

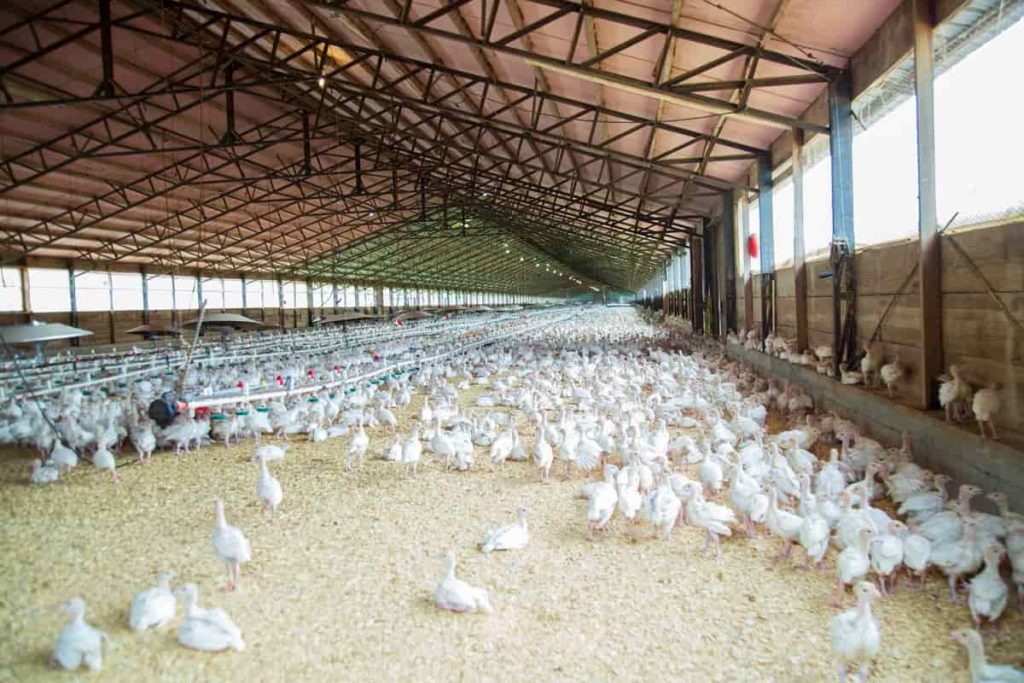

Introduction to poultry farm insurance in India: In all regions, poultry production is growing rapidly, geographically concentrated, vertically integrated, and connected to global supply chains. Poultry farming is a volatile business in India, which usually has huge profits as well as losses. In the event of the death of a bird, the farmer loses his income and the breeding program is disrupted.

If the loss exceeds a certain limit, Poultry Insurance compensates the farmers so that the farmer can fully control the loss. Poultry insurance serves as a risk transfer mechanism for a small premium. The Poultry Insurance Scheme applies to all types of exotic and crossbred poultry birds of poultry farms in India.

Poultry farming is a delicate business, which often suffers huge losses. In case of the death of birds, the farmer loses his income and the breeding program is disrupted. Poultry insurance compensates farmers if the loss exceeds a certain limit.

Because farmers cannot fully control losses, poultry insurance is a prudent way to transfer risk for a small premium that may be part of the operating budget. With the ever-increasing need for agricultural financing, poultry insurance can act as a guarantee for obtaining loans from banks. This insurance gives the farmer peace of mind to invest in the poultry business without fear of complete loss.

Guide on poultry farm insurance in India, covered risks & major emissions, farmers’ responsibility, and importance of poultry farm insurance

Poultry farm insurance

It provides compensation to poultry birds including layers, broilers, and hatchery birds. (Breeding stock) which are exotic and crossbred. Indigenous and non-native birds will not be insured. The scheme applies to poultry farms with a minimum of 100 birds under the scheme category and 500 birds under the non-scheme category and under general broilers – 100 per batch, layers 500 per batch, and hatching 200 birds per batch.

Covered risks – The policy will provide compensation against the death of birds due to accidents (including fire, lightning, flood, storm, strike, riot and civil unrest, and terrorism) or diseases transmitted during the insurance period.

Major Emissions – Injury, Deliberate Injury, Transportation, Theft and Secret Sales, Intentional Slaughter, Avian Leucosis Complex Disease, War and Nuclear Threats, Improper Management, Under Growth, Cannibalism, Predatory Action, Permanent and Partial Disability, loss of productivity and standard exclusion.

What is covered?

Deaths due to the following causes;

- Diseases, including epidemics

- Emergency slaughter on medical grounds

- Farm accidents

- Fire, lightning, flood, and wind

- Accidents in transit from breeders to farms

- Bird theft

Farmers’ responsibility

- Vaccinations of stock vaccination against common and common diseases according to programs.

- Maintain good poultry and management practices.

- Maintain good and up-to-date production records.

- Comply with local legal requirements such as vaccination and quarantine.

Importance of Poultry Farm Insurance

Poultry insurance offers many important benefits for protecting your animals and your investment. Here are seven reasons why poultry insurance is not a luxury, it is a necessity.

1. Protection under a farm policy

If you have a small to medium-sized spread, Farm Policy protects your structures and animals. Like homeowners’ insurance, this policy covers poultry individually or as a herd. Your poultry is covered if they are in your insured area, but not when they are in transit or away from your spread. This policy also protects other personal property, such as farm equipment, hay, feed, structures, and your home.

2. Life is protected from dangers faster

Your poultry must be covered in a serious emergency such as a fire, smoke exposure, or explosion. Your poultry should be covered by risk insurance in case of theft, flood, or earthquake. If your poultry is hit by a vehicle or dies in a collision with the vehicle carrying them, it is also covered. This additional clause protects against extreme hazards such as falling rocks on animals, attacks by predators, or even accidental shooting.

3. Animal mortality coverage

Limited coverage of animal deaths can compensate you for poultry that dies from the injury. If you need broader coverage, complete animal death compensates you for animals that die of disease or age. Sadly, poultry dies for several reasons, but this form of insurance can help you offset your losses.

Read the policy carefully to find out what conditions apply to your animals if they die. If the cattle die from a pre-existing condition or if the death is due to the owner, chances are you will not be covered. Make sure your animals are healthy because you have to prove this before you can renew your animal mortality coverage.

In case you miss this: Top 50 Dairy Farming Tips, Ideas, and Techniques

4. Protection against falling prices

If you are a poultry producer who sells your animals as a commodity, this form of insurance can protect you from financial losses. The policy is supported by USDA and pays you if the cash price index falls below a certain amount. For farmers and ranchers who sell their lambs, cattle, or pigs for slaughter, your investment is protected from serious losses.

5. Stray animals are covered

Animals have their brains. Sometimes, they get lost on your farm. This poultry insurance is usually an option. But it is important if you are worried about animals escaping and accidentally harming or dying.

6. Stay safe from liability

As poultry can be unpredictable, you must include some form of liability coverage with your insurance. This protects you from damages claims against you or your property. Poultry liability insurance aims to avoid a costly lawsuit. This extra layer of protection gives you peace of mind.

Poultry Sukshma Bima Policy

Scope – This scheme provides rates, terms, and conditions for underwriting the poultry insurance business in India. Poultry refers to (a) layers (b) broilers (c) parent stocks (hatcheries) which are exotic and crossbred. Indigenous and non-native birds will not be insured. After that, only comprehensive cover and parent stock (hatchery) cover are available.

- Exotic birds mean those whose parents are of foreign origin, including birds born in India and birds born abroad.

- A cross-bred bird for insurance purposes means that one of the parents is of foreign descent.

- Apart from the above, suggestions regarding birds do not fall under the scope of this scheme.

Applicability

- This applies to poultry farms in India

- The farm should cover all the birds. After issuing the policy, if additional birds are introduced in the form, immediate notification will be given to the insurer otherwise the claim will be rejected.

- This scheme applies to poultry farms in which the minimum number of birds is as under;

i. (Under bank finance (for all kinds of birds)

- Scheme: 100 (or as per IRDP norms)

- Non-Scheme: 500

ii. General

- Broiler 100 per batch

- Layers 500 per batch

- Hatchery 2000 birds per batch

Bajaj Allianz Poultry Insurance Policy

While insured Bajaj Allianz General Insurance Company Ltd has submitted a proposal which has agreed to be the basis of this policy and has paid the premium stated in the schedule, now the company agrees, subject to the following terms, limitations, exceptions, and exemptions, the insured is subject to compensation over the deductible amount and is always subject to the limitation of compensation against such loss as provided herein.

Coverage

In case of any insured event, as provided under the policy period and notified as proposed, the company will pay according to the amount provided but the sum insured stated in the schedule or to the extent of compensation. The Company hereby agrees that, under the terms, conditions, and provisions contained herein, it has either been verified or otherwise stated here that after payment of the premium, the Company will indemnify the Insured for Claims made in respect of the death of birds (described in the schedule and belong to the insured), which occurred during the term of the insurance or contract occurred, due to;

- Accident (including fire, lightning, flood, earthquake, strike, riot, or terrorist act)

- All diseases except those that are exclusively excluded. The Company will pay compensation to the insured to the extent specified in the Compensation Schedule (providing assessment by age for compensation) beyond the applicable limit and subject to policy avoidance provisions and exclusions.

Maintenance

The insured must have adequate veterinary facilities and ensure good housekeeping of the farm. Birds should be obtained only from approved standard hatcheries. Adequate records of daily stock positions, feed consumption, and egg production must be maintained by the insured.

In case you miss this: Meat Sheep Breeds, List, and Advantages

Debugging should be done by a properly trained person also pesticides should be given from time to time and their record should be maintained by the insured. Veterinary Surgeon’s Certificate must be submitted in the prescribed form for birds changed/added during the currency of this policy.

Scope and features of poultry insurance

‘Poultry’ refers to poultry units that include chickens/hens/chickens, ducks, turkeys, quails, and other such domestic birds which are reared for eggs and/or meat. This includes (a) layer birds (b) broilers (c) hatchery birds (breeding stock).

Applicability

- All poultry birds on the farm should be covered

- The scheme applies to poultry farms consisting of a minimum number.

- Layered birds (ii) Broilers per batch iii) Breeding of birds in hatcheries

Features

- It is a comprehensive insurance scheme applicable to poultry farms consisting of layer birds, broiler birds, and parent stock (hatcheries) which are exotic and crossbred.

- All birds should be covered in one form. After issuing the policy, if additional birds are introduced in the form, immediate notification will be given to the insurer otherwise the claim will be rejected.

- This scheme applies to poultry farms that specify a minimum number of birds.

- This scheme is available for insuring birds in the following age groups.

Broiler

- 1 day to 8 weeks

- 1 day to 6 weeks

Layers

- day to 20 weeks

- 21 weeks to 72 weeks

- 1 day to 72 weeks

Hatchery birds (parent stock)

- Premium rates Percentage are applicable based on the bird’s peak price in the applicable categories.

- The sum insured is the highest value and is Rs. 45 for broilers and Rs. 75 for layers. The policy contains a weekly valuation table which is used to calculate the compensation. This is negotiable in the case of the parent stock.

- The policy feature is extra and the final compensation is limited to 80% (60% in the case of Gamboro).

- The feature of the scheme is the exception of any claim as well as the exception of good features.

In case you miss this: How to Start Poultry Farming in Karnataka

Major exclusions

- Malicious/intentional injury, negligence.

- Transit from any mode of transport.

- Natural death, loss/death due to unspecified or unknown diseases or causes.

- Cannibalism, action, or predators like preying birds and carnivorous animals.

- Theft and clandestine sale of birds.

- Intentional slaughter of birds, except in cases where destruction is necessary to eliminate human incurable suffering and minimize additional losses based on a certificate issued by a qualified doctor to protect the remaining healthy herd. Surgeons or in cases where the insurance company has resorted to destruction by order of a legally constituted authority under notice. However, there was a consequential loss.

- Permanent and partial disability of any kind.

- Decreased production means not laying the required number of eggs or small size eggs in layers for any reason or not gaining proper weight in broilers at a certain age.

- Some important diseases in poultry birds are Marek’s disease, Ranikhet disease, fowl pox, and infectious bronchitis. If the birds are successfully vaccinated against these diseases and the necessary veterinary certification is provided to the company then these diseases come under the policy. Coccidiosis and other diseases are covered only if precautionary and therapeutic measures are taken from time to time.

- Death due to starvation due to malnutrition/lack of water, lack of food supply to birds, or similar reasons.

- Under Growth

- Damage caused by birds huddled and/or piling of birds.

- Avian leucosis complex (ALC)

- War, invasion, foreign enemy action, hostility (whether war is declared or not), civil war, uprising, revolution, uprising, uprising, riot, military or aggression, or any of its consequences or dangers.

Identification

All birds will be covered on a flock basis. No identification is required. The insured must maintain a record of their cost to show, among other things, (a) deaths (b) culling (c) feed consumption (d) disease incidence (e) vaccinations and medicines (f) purchases and sales (g) daily stock register

Important policy terms for poultry farm

- Poultry farms should have veterinary facilities.

- Cages must be properly cared for if used.

- Proper home maintenance.

- In the event of an outbreak, all healthy birds should be isolated and all precautionary measures should be taken to prevent the spread of the disease.

- Birds should be provided with adequate balanced standard food and clean water.

- Adequate herd records should be maintained daily.

- Interest/transfer of property is not allowed.

- In case of death/outbreak, immediate notice should be given to the company within 12 hours. All birds should be prepared separately for the company representative or any person chosen by the company.

Blanket Policies

Blanket policies will be issued, with weekly announcements in favor of clients who have a regular record of each unit/lot by which the bird group can be identified and in which all diseases have been encountered. Treatment is provided and vaccination will be recorded as usual. Business course. Upon receipt of new stock announcements, an additional premium will be charged at the agreed rate, subject to a veterinarian’s certificate.

Procedure for settlement of claims

Acceptability of claim

Under the policy, the claim will be admissible only if the death rate in the herd exceeds the threshold given below: (for example)

- Broilers – 5% of the population in 1 day to 8 weeks each.

- Layers – 1 day to 8 weeks 5% of the population in each lot 9 weeks to 72 weeks 3% of the population in each lot will be compensated for the loss of birds only for the death of birds above the above mortality rate.

In case you miss this: How to Start Poultry Farming in Haryana

Company liability

The insured will be compensated for 100% of the value of the bird at the time of death.

Salvage – No salvage will be made from the defense claim.

Responsibility of farmers

- Vaccinate all chickens against common and common diseases as per the vaccination program.

- Maintain good poultry management practices.

- Maintain daily production record.

- Comply with the rules under local legal requirements.

Veterinary examination

A veterinary certificate from an authorized veterinarian showing the following details is required to accept the risk;

- Bird type

- Bird age

- Birth Housing, lighting, ventilation, temperature, insulation, floor, Details about feed, water, sanitation, etc.

- Details of vaccination and immunization.

- Debeaking

- Health status

- Type and source of feed

- Equipment details

- Administration / Staff details

- Veterinary assistance

The insurer reserves the right to retain his checks and deputies.

How to affect insurance?

- Proposal Form

- Veterinary Health Certificate

- The form should cover all birds.

- The form should follow the standard package of practice, vaccination schedule, deforming.

- The form must keep the required records as per the insurer’s specifications.

- Poultry Farm Insurance in India, Companies, Policy, and Premium

- Top 20 Seed Companies in India

- Top 19 Livestock Feed Companies in India

- Pig Diseases, Symptoms, and Treatment

- Goat Farming Insurance in India, Companies, Policies, and Premiums

- How to Improve Agriculture in the Philippines, Ways, Ideas, and Tips

- Dairy Disease Symptoms and Treatment for Cows, Cattle, Goats, and Sheep

- Sustainable Agriculture in India, Policies, Examples, and Practices

- How to Improve Agriculture in Africa, Ways, Solutions, and Strategies

- Poultry Farming in Tamil Nadu, How to Start, Schemes, Loans, and Subsidy

- Top 50 Rabbit Farming Tips, Ideas, and Techniques

- Poultry Farming in Uttar Pradesh, How to Start, Schemes, and Loans

- How to Improve Agriculture Production, Tips, Ideas, Ways and Techniques

- Top 50 Flower Farming Tips, Ideas, and Techniques

- Fish Farming in Tamil Nadu, How to Start, Tips, Ideas

- Top 50 Sheep Farming Tips, Ideas, and Techniques

- Top 50 Herb Farming Tips, Ideas, and Techniques

- Top 50 Dairy Farming Tips, Ideas, and Techniques

- Top 10 Agriculture Universities in the World, Best List

- Top 50 Goat Farming Tips, Ideas, and Techniques

- Top 50 Fish Farming Tips, Ideas, and Techniques

- Dairy Farming in Andhra Pradesh, Breeds, How to Start?

- Top 50 Poultry Farming Tips, Ideas, and Techniques

- How to Buy Agriculture Land in Punjab, and Who Can?

- Dairy Farming in Uttar Pradesh, How to Start

- How to Start Poultry Farming in Haryana

- How to Buy Agricultural Land in Nigeria

- How to Start Poultry Farming in Karnataka

- How to Buy Agricultural Land in Mexico

- Future of Agriculture in India

- How to Buy Agricultural Land in Uttar Pradesh

- How to Buy Agricultural Land in Uttarakhand

- Organic Farming in Meghalaya, How to Start

- Who Can Buy Agricultural Land in Vietnam

- How to Start Organic Farming in Jharkhand

- How to Buy Agriculture Land in India & Who Can?

[ad_2]

Source link

Leave a Reply